ESG Library SFDR Sustainability-Related Disclosure

SFDR Sustainability-Related Disclosure

Principal Adverse Impact Statement (252KB)

Summary of SFDR Article8 Pre-Contractual Disclosure (643KB)

Product name: Sekisui House Reit, Inc.

Legal entity identifier:TKS:3309

Sekisui House Reit, Inc. (“SHR”) promotes environmental or social characteristics, but does not have as its objective a sustainable investment within the meaning of Article 9(1) of Regulation (EU) 2019/2088 (“SFDR”). SHR does not have any employees in accordance with the prohibition on having employees under the Act on Investment Trusts and Investment Corporations of Japan, and relies on Sekisui House Asset Management Co., Ltd. (the “Asset Manager”) to manage and operate the properties in SHR’s portfolio. SHR and the Asset Manager are hereinafter referred to collectively as “we,” “us” or “our”. References to “fiscal year” or “FY” are to the 12 months began or beginning April 1 of the year specified, unless noted otherwise.

Summary

| No sustainable investment objective | The financial products offered by SHR promote environmental or social characteristics, but do not have as its objective sustainable investment. |

|---|---|

| Environmental or social characteristics of the financial product | We conduct real estate investment management that takes into consideration environment, social and governance factors in accordance with Sekisui House, Ltd.’s Sustainability Vision, which aims to achieve the following targets: decarbonized society, society in which humans and nature coexist, a circular economy, society characterized by health and longevity, and diverse society. The Asset Manager has established a Sustainability Policy consistent with this vision. We implement various environmental initiatives and various social initiatives, as described below. |

| Investment strategy | We believe that there is a growing need for real estate in locations that provides sustainable living to residents and locations that can be sustainable bases of operation for tenants’ businesses. We also believe that there is demand for real estate with high, basic functionality as residences, such as comfort and safety, and functionality desired by tenant businesses. We issue green bonds and enter into green loans that take into consideration ESG factors using our green finance framework. In addition, we have introduced various measures to assess and enhance our governance systems. |

| Proportion of investments | SHR offers financial products which promote environmental or social characteristics, but does not have sustainable investments as its objective. We achieved the previous KPI which was to increase the percentage of Green Certified Assets in SHR’s portfolio to 70% or more by fiscal year 2022 based on gross floor area and aim to maintain the percentage at the same level thereafter. |

| Monitoring of environmental or social characteristics | We use the following indicators to measure the attainment of the E/S characteristics we promote; (i) Environmental certification of individual properties; (ii) ESG assessment of SHR; (iii) Tracking of environmental performance data; (iv) Principles for Responsible Investment (“PRI”); (v) Promotion of Green Leases; (vi) Human Resource Development. |

| Methodologies | We identify material issues and establish KPI to measure the progress of our social and environmental improvement initiatives, and have the Sustainability Committee monitor progress and review targets. The Sustainability Committee consists of the following members of the Asset Manager: Chief Executive Officer (President and Representative Director), Chief Operating Officer (Director in charge of ESG Promotion Department), full-time directors, Compliance Officer and heads of all departments. The Sustainability Committee aims to enhance the sustainability promotion system, and is responsible for setting targets and developing a system to promote sustainability. Details on the indicators above are described below. |

| Data sources and processing | As further described below, the Asset Manager obtains third-party assurance or work with independent vendors to ensure the accuracy of collected date. |

| Limitations to methodologies and data | The primary limitation to methodologies and data is the necessity of reliance on tenants and property management companies for data at the property level. Like many other real estate investment corporations and asset managers, we rely on data provided by the tenants and property management companies. In addition, data at the property level provided by the tenants and property managers is generally updated on an annual basis. Accordingly, property-specific data will therefore not always be fully up-to-date. Data at the property level is compiled internally at the Asset Manager, but the data is confirmed by the relevant departments and the environment-related data at the property level is verified by a third-party organization. Limitations to the methodologies and data are not expected to affect the attainment of the environmental or social characteristics promoted by SHR in any material way. |

| Due diligence | Prior to SHR’s investment in a property, the Asset Manager conducts due diligence on the property, including environmental risk assessment, by investigating the history of use of hazardous substances such as asbestos and PCB, geological conditions and soil contamination. |

| Engagement policies | We do not consider investing in properties that do not meet the standards for soil contamination and other environmental contamination in accordance with the Air Pollution Control Act and the Soil Contamination Countermeasures Act of Japan and other environmental laws and ordinances. However, from time to time we acquire properties not meeting the standards as long as they are deemed fixable promptly after acquisition. Also, we make investment decisions for properties outside Japan in accordance with the applicable environmental laws and ordinances in the respective jurisdictions and based on reasonable local practices. |

| Designated reference benchmark | SHR has no benchmark index designated as a reference benchmark to meet the environmental or social characteristics promoted by SHR. |

No sustainable investment objective

The financial products offered by SHR promote environmental or social characteristics, but do not have as its objective sustainable investment.

Environmental or social characteristics of the financial product

We conduct real estate investment management that takes into consideration ESG factors in accordance with a vision of “managing assets to better provide for people, society and the future”. We believe that addressing social issues through asset management that takes ESG into consideration will contribute to the realization of a sustainable society and enhance stakeholders’ trust, thereby contributing to securing stable earnings over the medium to long term and maximizing unitholder value.

SHR does not have a specific index designated as a reference benchmark to determine whether SHR is aligned with the environmental or social characteristics that it promotes.

We implement various environmental initiatives including the following:

- Addressing Climate Change. We aim to reduce energy consumption intensity of SHR’s portfolio by 10% by FY2028 compared to the level in FY2018. As our medium term target, we aim to reduce the combined amount of Scope 1 and Scope 2 greenhouse gas (“GHG”) emissions by 42% by FY2030 compared to the level in FY2021. We also started monitoring and tracking Scope 3 GHG emissions from FY2021 and aim to reduce them going forward. As our long term target, we aim to achieve net zero by FY2050. We also aim not to increase waste emission intensity and water use intensity of our portfolio compared to the level in FY2018.

- Reducing Energy Consumption. We install LED lighting, energy-saving air-conditioning systems, and other equipment with low environmental impact on SHR’s properties. We also have made other energy-saving investments, including solar power generation panels, Low-e double-glazed windows with thermal shielding and thermal insulation capability, flow control valves that prevent water overflow, showerheads with water-saving features, and chargers for electric vehicles. In addition, in line with the long term target of achieving net zero GHG emissions, we have switched to renewable energy-sourced electricity at most of the properties in SHR’s portfolio as of today and have introduced virtual renewable energy through the purchase of non-fossil fuel energy certificates at the Non-fossil Fuel Energy Value Trading Market of the Japan Electric Power Exchange via a broker. By purchasing the non-fossil fuel energy certificates corresponding to the electric power consumption in the common area of the properties, CO₂ emissions from the electricity usage of the properties have become virtually zero at certain properties. In addition, SHR has acquired validation through SBTi (Science Based Targets initiative) in May 2023 regarding the medium term GHG reduction target.

- Biodiversity Conservation. We are committed to the “Gohon no Ki” (meaning five trees in Japanese) Project, initiated by Sekisui House, Ltd. (the “Sponsor”) toward the creation of gardens and communities. Through this project, we aim to co-exist with the surrounding nature by creating gardens with indigenous trees that are in harmony with Japan’s nature and climate. Garden City Shinagawa Gotenyama and Hommachi Garden City have rooftop gardens. The greening of rooftops improves thermal insulation performance and contributes to the creation of a natural environment in urban areas. In addition, we replanted trees and other vegetation for Esty Maison Kayaba and other residences in 2022. When replanting, in accordance with the Gohon no Ki Project, we confirm the details of the replanting, such as the selection of native species of trees and vegetation and whether there are any non-native species that require comprehensive mitigation measures.

- Urban Revitalization/Urban Development (1). We, in cooperation with the Sponsor, aim to create sustainable cities through the acquisition of environmentally-friendly properties developed by the Sponsor, which is focused on developing properties using natural energy and adopting energy-saving technologies. Prime Maison Gotenyama East, Prime Maison Gotenyama West, Garden City Shinagawa Gotenyama, and Gotenyama SH Building owned by SHR are properties planned and developed under Sekisui House’s large-scale complex development called “Gotenyama Project”. It is not only a large-scale development that advocates a sense of scale, but also is based on the revitalization of the original landscape of “Gotenyama”, which is rich in nature, and creating an expressive and intimate human-scale townscape. In addition, the project focuses on environmental considerations and actively uses natural energy and adopts advanced energy-saving technologies. In the Gotenyama Project, more than 40% of the total development area is covered with vegetation and plants through exterior planting and rooftop greenery. Based on Sekisui House’s proprietary Gohon no Ki Project, which takes into account the ecosystem of Japan’s original “Satoyama” landscape, a green network that is integrated with greenery in the surrounding area through the preservation of existing trees and planting over 26.4 thousand trees, mainly indigenous species.

- Urban Revitalization/Urban Development (2). We, in cooperation with the Sponsor, aim to create sustainable cities through the acquisition of environmentally-friendly properties developed by the Sponsor. “Prime Maison EGOTANOMORI” is a property planned and developed by the Sponsor through the “EGOTANOMORI Project”, a large-scale urban development project carried out on land owned by the Urban Renaissance Agency. The property consists of five different buildings: Prime Maison EGOTANOMORI EAST/WEST (rental condominiums for families), MAST ONE EGOTANOMORI (a rental condominium for students and single-persons), GRAND MAST EGOTANOMORI (serviced housing for the elderly), and NICHII HOME Egotanomori (a paid nursing home with long term care). The area where this property is located is blessed with a rich natural environment and has been designated as a wide-area evacuation site in the Tokyo Metropolis. In the Nakano City urban planning master plan, the area is considered to have sufficient evacuation routes and an environment that is harmonious with the abundant greenery in the surrounding area, and is positioned to promote the supply of good housing complexes, etc. In addition, the community was developed under the concept of creating a sustainable community nurtured by multiple generations in order to take advantage of the many schools, medical facilities, and facilities for the elderly in the area. We aim to develop a community that regenerates as an area where diverse generations live together, including students, young family households starting to raise children, and elderly people who want a safe and comfortable life.

- Promotion of Green Leases and Collaboration with Tenants and Property Managers. We, in collaboration with tenants and property managers, implement various environmental measures, such as for energy conservation and CO₂ reduction, at some of SHR’s properties. At Akasaka Garden City, tenants are regularly convened to hold CO₂ reduction promotion meetings, where energy consumption and CO₂ emissions are reported to each tenant, and energy conservation efforts are explained in conjunction with these reports to raise environmental awareness. We also enter into lease agreements, which include provisions that require our tenants to cooperate with us in collecting energy consumption data, obtaining green certifications and taking other environmental measures and engaging in other ESG efforts such as reduction of waste generated during renovation of buildings and use of building materials that are environmentally-friendly (such lease agreements, the “Green Leases”), with our tenants. We have set “achieving 25% or more of the portfolio with Green Leases by FY2030” as one of our KPI targets. As of today, we have entered into Green Leases with more than 25% of the tenants at SHR’s properties based on the leasable area. In addition, by conducting and monitoring tenant satisfaction surveys via external evaluation agencies, we strive to improve environmental awareness among tenants and suppliers.

We implement various social initiatives at SHR’s properties including:

- Contribution to Local Communities. We open the entrance halls, ground-floor lobbies, meeting rooms, coworking space and other areas of SHR’s properties to support local events and contribute to the environment and health of local communities. In addition, we have introduced share bikes and food trucks at some properties for tenants and local residents. We have also installed disaster relief vending machines to allow anybody to get free drinks during times of disasters or other emergencies, as well as AEDs.

- Providing Safety, Security, and Comfort for Tenants. In preparation for typhoons, earthquakes, and other disasters which have caused enormous damage in recent years, we have installed and introduced disaster prevention facilities and equipment such as emergency power generators, disaster prevention centers and quake-absorbing structures in some of SHR’s properties, so that tenant businesses and residents feel safe. Garden City Shinagawa Gotenyama, for example, is equipped with all the above disaster prevention facilities. Similarly, Hommachi Minami Garden City takes business continuity into account by using seismic bracing installed on each floor to absorb the forces that would act on the building in a major earthquake, and by situating its mechanical room on the 3rd floor, above flood level. We have also equipped Prime Maison Shinagawa with solar batteries, storage batteries, and emergency generators designed for emergency power supply systems. We conduct tenant satisfaction surveys, the findings of which are shared with property managers, building managers and other related parties so that they can be responsive to tenants’ needs and improve their services.

- Acquisition of Certification for Comprehensive Assessment System for Built Environment Efficiency (“CASBEE”) Wellness Office. Garden City Shinagawa Gotenyama became the first property in SHR’s portfolio to receive the Certification for CASBEE Wellness Office for the first time, and was certified as the highest evaluation rank, “S Rank”. Furthermore, the property has received “S Rank” of the Certification for CASBEE for Real Estate and, is eligible to receive “S Rank” of the Certification for CASBEE Smart Wellness Office which can be received by combining each certification.

- Creating Comfortable Workplace Environment for Employees. The Asset Manager, as a member of Sekisui House Group, has made efforts to reduce overtime work and increase the ratio of employees taking annual paid leave, to promote better work-life balance. For example, the Asset Manager has established an annual paid leave system that allows employees to take up to five days out of the eligible leave period on an hourly basis, and flexible workdays that allow employees to shift their start and end times at work, both of which are widely used for child rearing, family care and family events. The Asset Manager has set average monthly work hours per person of 162 hours and usage rate for annual paid leave of 70%, in each case by the end of the Asset Manager’s fiscal year ending January 31, 2024, as its KPI targets. The Asset Manager has also established the Health Committee, which meets once a month with an occupational physician. The Health Committee offers workshops to employees to help them manage their health and safety in their workplaces. The Asset Manager also conducts stress checks to protect employees from mental distress.

- Promoting Diversity. The Sekisui House Group’s Human Rights Policy stipulates that the Group will continuously promote the creation of a corporate structure with zero tolerance for any discrimination or harassment based on birth, nationality, race, ethnicity, beliefs, religion, gender, sexual orientation, gender identity, age, disabilities, preference, educational background, family, etc., in order to promote diversity. As a member of the Group, the Asset Manager also implements initiatives for women, senior employees and persons with disabilities to give them active participation opportunities in the work environment in accordance with this policy.

- Internal Reporting System. The Asset Manager operates a Compliance Hotline based on the Whistleblower Protection Act of Japan to strengthen its compliance through early detection and correction of fraudulent actions. The Hotline accepts meeting requests or reports from all directors and employees regarding any violation of law and is designed to appropriately deal with them. The Compliance Officer or Internal Control Promotion Department investigates each case and takes corrective action and implements measures promptly to prevent recurrence and discipline relevant parties as appropriate. In addition, directors and employees of the Asset Manager, and directors and employees of subcontractors and business partners with whom Sekisui House Group has ongoing business relationships can also use the Sekisui House Group’s Compliance Helpline for handling consultation regarding concerns pertaining to legal and corporate ethics infractions and transaction-related issues.

- Respect for Human Rights. To ensure respect for the human rights of all stakeholders in our business, we are continuously working to cultivate a corporate culture that prevents discrimination, harassment and human rights violation based on international rules on human rights such as the United Nations’ Universal Declaration of Human Rights, the SDGs and the Ten Principles of the UN Global Compact. The Asset Manager strives to ensure that there is no human rights violation, including harassment, by creating a workplace where all employees can work enthusiastically and achieve growth according to the Sekisui House Group’s Human Rights Policy, established by Sekisui House in April 2020. All directors and employees of the Asset Manager take the human relations training once a year as a member of Sekisui House Group.

- Endorsement of Advance. The Asset Manager is committed to ensuring that all directors and employees fulfill their responsibilities to respect human rights in accordance with the Sekisui House Group Human Rights Policy. Believing that the objectives of “Advance”, an initiative established by PRI (defined below) that calls for action on human rights and social issues, are in line with the Sekisui House Group Human Rights Policy, the Asset Manager has signed on as an endorser in March 2023.

- Human Resource Development. The Asset Manager has made efforts to encourage employees to acquire qualifications to develop expertise such as the ARES Certified Master, a certification received after attending an educational program that teaches practical know-how in real estate and finance, and the Asset Manager covers the associated expenses incurred by employees. In addition, the Asset Manager established the training system and this tiered professional development program builds leadership for raising organizational productivity by tailoring learning to the skills and requirements of each job level. The Asset Manager has the set annual internal training participation rate of 100% and annual participation in external training events per person of 2.0 events as its KPI targets. Additional information (including performance data) on the Asset Manager’s employees and human resource development can be found on our website: https://sekisuihouse-reit.co.jp/en/esg/library/data.html.

Investment Strategy

SHR invests directly or indirectly through trust beneficiary interests in real estate. Therefore, due diligence (including the assessment of good governance practices) in relation to investee companies is not applicable. The investment and due diligence policies as described below are related to real estate and real estate-related assets.

We believe that there is a growing need for real estate in locations that provides sustainable living to residents and locations that can be sustainable bases of operation for tenants’ businesses. We also believe that there is demand for real estate with high, basic functionality as residences, such as comfort and safety, and functionality desired by tenant businesses. By leveraging the Sponsor’s know-how in the operation and management of real estate, we promote environmental initiatives such as energy saving and safe living and business continuity for the benefit of residents and tenant businesses.

In line with the above investment strategy, we issue green bonds and enter into green loans that take into consideration ESG factors using our green finance framework.

-

Green Finance Framework. SHR’s green finance framework, which was established in 2022, is applicable to both green bonds(Note) and green loans, under which certain environmentally-friendly investment projects (“Eligible Green Projects”) are evaluated and selected by the Sustainability Committee, which is chaired by the Asset Manager’s President & Representative Director and participated by all full-time directors, Compliance Officer and heads of all department of the Asset Manager, in accordance with its Sustainability Policy and eligibility criteria described below.

(Note)Information about the former green bond framework that applies to the outstanding green bonds issued prior to the green finance framework can be found on our website: [ https://ssl4.eir-parts.net/doc/3309/tdnet/1656516/00.pdf ]

-

Eligibility Criteria. A building that received a third-party certification described below at the borrowing or payment date of green finance, and/or that is expected to receive such certification:

- 3, 4, or 5 Stars under the DBJ Green Building Certification;

- B+, A or S rank under the CASBEE certification for Real Estate;

- BELS Certification: 3 Stars, 4 Stars, 5 Stars; or

- BELS Certification: following assessment of ZEH and ZEB

- ZEH-M, Nearly ZEH-M, ZEH-M Ready, ZEH-M Oriented; or

- ZEB, Nearly ZEB, ZEB Ready, ZEB Oriented.

-

Eligibility Criteria. A building that received a third-party certification described below at the borrowing or payment date of green finance, and/or that is expected to receive such certification:

- Management of Procured Funds. We intend to allot the funds procured through green bonds and green loans towards Eligible Green Projects. As long as the outstanding green bonds or the green loan balance exist, we will manage to ensure that the total amount of the outstanding green bonds and the green loan balance does not exceed a certain threshold based on the total acquisition price of Eligible Green Projects and our LTV as of the end of the latest fiscal period. In addition, we will report that the total amount of funds procured through green bonds and green loans has been fully allocated to Eligible Green Projects and as long as the outstanding green bonds or the green loan balance exist, the allocated funds will be tracked and managed internally on a portfolio basis. If all or part of the funds procured through green bonds or green loans is not immediately allocated to Eligible Green Projects, we will identify unappropriated funds and manage all or part of the funds raised in cash or cash equivalents until the unappropriated funds are allocated to Eligible Green Projects.

- Third-party Eligibility Assessment. We acquired “Green 1(F)”, the highest rating in “Green Finance Framework Evaluation” from Japan Credit Rating Agency, Ltd. (JCR) as a third-party evaluation of the Framework.

A binding element of the investment strategy is the use of the proceeds of green bonds or green loans under our green finance frameworks described above. Eligible Green Projects are evaluated and selected by the Sustainability Committee, which is participated by the Asset Manager’s President & Representative Director as Chief Sustainability Officer, the Director in charge of ESG promotion as Chief Sustainability Operator, all full-time directors, the compliance officer, and all heads of departments of the Asset Manager., in accordance with its Sustainability Policy and eligibility criteria described above. When we select assets for investment in connection with our Green Bonds, the properties must meet the eligibility criteria. We may also acquire properties that might be qualified for 1 or 2 Stars under the DBJ Green Building Certification or B under the CASBEE certification for Real Estate (together with Eligible Green Projects, “Green Certified Assets”) and do not meet our Eligibility Criteria (described above).

In addition, we have introduced the following measures to assess and enhance our governance systems:

- Adoption of a decision-making process in conflict-of-interest transactions involving independent outside experts. The Asset Manager has adopted frameworks that require (i) each decision regarding a conflict-of-interest transaction to be made by the Investment Committee and Compliance Committee, subject to the attendance and consent of external professionals who have no special interest in any interested party such as the Sponsor; and (ii) preliminary review by the Compliance Officer and the Internal Control Promotion Department, deliberation and resolution by the Investment Committee and Compliance Committee, deliberation and approval by the Board of Directors of the Asset Manager, and our consent based on deliberation and resolution of the Board.

- Internal audit system. The Asset Manager conducts annual internal audits every fiscal year. For the implementation of internal audits, the Asset Manager will formulate an internal audit plan for each business year based on the internal audit rules, and then verify whether our operations are carried out appropriately and efficiently in accordance with laws, regulations and internal regulations in addition to verifying whether the corporate ethics standards (including corruption, bribery and fraud) are complied. The results are then reported to the Compliance Committee, President & Representative Director, and the Board of Directors, and a policy is in place to provide recommendations or instructions for improvement to the relevant organizations and departments as necessary. The Asset Manager also retains outside experts to conduct audits as necessary.

- Transparent and appropriate information disclosure. We take into consideration the transparency of the information and the ease with which the shareholders will understand the information.

Proportion of investments

As of October 31, 2023, 82.8% of the properties in the portfolio based on gross floor area were Green Certified Assets, and 17.2% were not Green Certified Assets. We achieved the previous KPI target of achieving a portfolio of 70% or more of which constitutes Green Certified Assets by FY2022 based on gross floor area and aim to maintain the percentage at 70% or higher thereafter.

Monitoring of environmental or social characteristics

We use the following indicators to measure the attainment of the E/S characteristics we promote:

- Environmental certification of individual properties. To track the environmental performance of SHR’s properties, we rely on certifications issued by third-party organizations, such as the Development Bank of Japan’s (“DBJ”) Green Building Certification and Certification for Comprehensive Assessment System for Built Environment Efficiency (“CASBEE”) for Real Estate.

- ESG assessment of SHR. To track our ESG performance, we obtain third-party assessments, such as Global Real Estate Sustainability Benchmark (“GRESB”) Real Estate Assessment, the Corporate Sustainability Assessment by S&P Global (“CSA”), MSCI ESG Ratings, FTSE Russell ESG Rating and FTSE4Good Index Series and MUFG ESG Rating Certificate for J-REITs supported by Japan Credit Rating Agency, Ltd. (“JCR”).

- Tracking of environmental performance data. The Asset Manager tracks and monitors data on CO₂ emissions, energy consumption, water use, generated waste and renewable energy power generation of the properties that we provide the utility management services in SHR’s portfolio.

- Principles for Responsible Investment (“PRI”): The PRI was established for the financial industry in 2006 under the leadership of the then-United Nations Secretary-General, Kofi Annan, together with an international network of investors. In 2019, the Asset Manager became a signatory and supports the PRI by incorporating ESG consideration into its investment analyses and decision-making process.

- Promotion of Green Leases. The Asset Manager tracks and monitors the proportion of the Green Leases among the tenants in SHR’s portfolio based on leasable area under the applicable lease agreements. As one of our KPI targets, we aim to increase the proportion of the portfolio under Green Leases to 25% or higher by FY2030 based on the leasable area.

- Human Resource Development. The Asset Manager has set a training participate rate of 100% and annual participation in external training events per person of 2.0 events, in each case by the end of the Asset Manager’s fiscal year ending January 31, 2024, as its KPI targets.

Methodologies

We identify material issues related to ESG and establish relevant KPIs to measure the progress of our social and environmental improvement initiatives, and have the Sustainability Committee monitor progress and review targets. The Sustainability Committee consists of the following members of the Asset Manager: Chief Executive Officer (President and Representative Director), Chief Operating Officer (Director in charge of ESG Promotion Department), full-time directors, Compliance Officer and heads of all departments. The Sustainability Committee aims to enhance the sustainability promotion system, and is responsible for setting targets and developing a system to promote sustainability.

- Environmental certification of individual properties. One of our KPI targets is to maintain the proportion of Green Certified Assets in SHR’s portfolio at 70% or higher based on gross floor area. As described above, we use third-party environmental certifications such as DBJ Green Building Certification and the Certification for CASBEE for Real Estate to determine whether a property qualifies as a Green Certified Asset and/or an Eligible Green Project along the green finance framework. In addition, the environmental certifications obtained for the properties in SHR’s portfolio are used for the ESG assessment of SHR by GRESB and other portfolio-level assessments. The progress and status of the environmental certifications of the properties in SHR’s portfolio are regularly reported to the Sustainability Committee of the Asset Manager by the Investment Management Division of the Asset Manager which in turn is reported to the Board of Directors of the Asset Manager as appropriate. The Investment Management Division discusses the policy for acquiring environmental certifications and proposes which properties to acquire environmental certifications. The department in charge of the budget for acquisition of the environmental certifications is the Investment Management Division, and the departments under the Investment Operations Division are responsible for the initial screening of properties, collection of data and supporting documents, submission of applications and follow-up communications with the issuing organizations. In order to ensure accuracy of data, the Asset Manager monitors and tracks environmental certification-related data in cooperation with property management companies and building management companies, of which performance is monitored and evaluated periodically by an external evaluation agency to verify their appropriateness. In addition, the evaluations required for DBJ Green Building Certification and the Certification for CASBEE for Real Estate include soil contamination, accessibility to public transportation and natural disaster risk countermeasures, which are also evaluated by us as part of our due diligence process prior to SHR’s investment in a property.

- ESG assessment of SHR. The assessment process for the GRESB Real Estate Assessment involves the submission of GRESB questionnaires by July of each year while the assessment process for the CSA involves the annual submission of the CSA questionnaires by the optional response period which SHR selected as September. The evaluation required for the GRESB Real Estate Assessment generally covers a broader scope of sustainability and ESG-related items than those evaluated for our due diligence process prior to SHR’s investment in a property. In addition to ESG-related items such as soil contamination, accessibility to public transportation and natural disaster risk countermeasures, which are covered by our due diligence process prior to SHR’s investment in a property, the GRESB Real Estate Assessment also evaluates the overall portfolio and asset management structure, the policies regarding ESG issues in the asset manager and the risk management system, including those related to climate changes, of the asset manager. The evaluation required for the CSA generally covers a broader scope of sustainability and ESG-related items such as transparency of disclosure and risk management in the "Governance & Economy" category, measures for addressing climate change in the “Environment” category and human rights initiatives in the “Society” category. The ESG related-data and supporting documents used for preparation of the responses to the CSA questionnaires are collected mainly by the departments under the Investment Operations Division, General Affairs Department and Internal Control Promotion Department. To ensure the accuracy of such environmental and social data, the Asset Manager engage a third-party organization to conduct an independent review and obtain verification of the data before the submission. The ESG Promotion Department is in charge of collecting data and submitting the final responses to GRESB and the CSA. The social and governance data and supporting documents are collected and prepared by the General Affairs Department and the ESG Promotion Department. The results of GRESB Real Estate Assessment and the CSA are reported to the Sustainability Committee and the Board of Directors of the Asset Manager as appropriate. The ESG Promotion Department analyzes the details of the final results, evaluates any room for future improvements and other data, and formulates action plans for progressing sustainability and achieving relevant KPI targets. MSCI ESG Ratings are designed to assess companies based on their disclosed ESG performance while FTSE Russell ESG Rating is designed to measure the performance of companies that demonstrate strong ESG practices, based on highly transparent management methods and clearly defined ESG criteria. MSCI and FTSE Russell collect data from a variety of sources, including company disclosures, regulatory filings, news sources and other public information. The ESG Promotion Department periodically contacts these evaluation agencies to request that they review and update our ESG ratings. MSCI and FTSE Russell then assess our ESG performance.

- Tracking of environmental performance data. In principle, the relevant departments under the Investment Operations Division collect property-level data on energy consumption, water use, generated waste and renewable energy power generation provided by each property’s property management company. The collected data is compiled at the portfolio level on a monthly basis, but the frequency of environmental performance data collection varies by property and data type. Specifically, the data on energy consumption and renewable energy power generation is collected monthly while the data on general waste is collected every twelve months. In addition, the data on water use is collected every two months to twelve months, depending on each property. To ensure the accuracy of environmental performance data, the ESG Promotion Department engages a third-party assurance organization to conduct an independent review of the compiled data and obtain an annual assurance report on the accuracy of the data.

- PRI. The ESG Promotion Department reviews the implementation status of our activities for the PRI and reports to the PRI on an annual basis. The ESG Promotion Department reports environmental and social data to the PRI upon obtaining third-party assurance, and reports to the Sustainability Committee, the Board of Directors, and the Executive Committee on the implementation of the annual report and assessments from the PRI.

- Promotion of Green Leases. The status of the adoption of the Green Leases is monitored and compiled by the relevant departments under the Investment Operations Division, reported to the Sustainability Committee and disclosed on our website. To be specific, the tasks to implement Green Lease clauses into new lease agreements are handled by the Operations Department 1 and 2 for the residential properties in SHR’s portfolio, and by the Operations Department 3 for the office properties in SHR’s portfolio.

- Human Resource Development. The internal training participation rate and the number of attendances at external training sessions are monitored and tracked by the General Affairs Department of the Asset Manager, and reported to the Sustainability Committee on a quarterly basis. The General Affairs compiles relevant data on a monthly basis. To ensure the accuracy of such human resources performance data, the ESG Promotion Department and the General Affairs Department engage a third-party assurance organization to conduct an independent review and obtain an annual assurance report on the accuracy of the data.

Data sources and processing

We use the following data sources:

- Environmental certification of individual properties. The property management companies initially collect the environmental performance data and supporting materials at the property level used in the applications for environmental certifications, and the departments under the Investment Operations Division are responsible for compiling the relevant data and supporting documents required by the established third-party organizations that issue environmental certifications. In principle, the Investment Management Division of the Asset Manager reviews and confirms the accuracy of the compiled data and supporting documents before submission.

- ESG assessment of SHR. As described above, the raw data at the property level is collected and provided by the property management companies. The ESG-related data and supporting documents used for the preparation of the responses to GRESB and the CSA questionnaires are collected and reviewed internally by the departments under the Investment Operations Division, General Affairs Department and Internal Control Promotion Department. The collected environmental and social data supporting documents are provided to a third-pay consulting firm. The third-party consulting firm compiles and reconciles the collected data and supporting documents for accuracy and consistency, and reports to the ESG Promotion Department, which is in charge of submitting the final responses to GRESB and the CSA. MSCI and FTSE Russell collect data from a variety of sources, including company disclosures, regulatory filings, news sources and other public information that we have publicly disclosed.

- Tracking of environmental performance data. As described above, the relevant departments under the Investment Operations Division collect property-level data on energy consumption, water use, generated waste and renewable energy power generation provided by each property’s property management company. The frequency of environmental performance data collection varies by property and data type, but the data is generally compiled on a monthly basis and submitted to a third-party consulting firm for an independent review of accuracy. In addition, the ESG Promotion Department engages a third-party assurance organization to conduct an independent review of the compiled data and obtain an annual assurance report on the accuracy of the data.

- PRI. The ESG Promotion Department reviews the implementation status of our activities for the PRI and reports to the PRI on an annual basis. The ESG Promotion Department reports environmental and social data to the PRI upon obtaining third-party assurance, and reports to the Sustainability Committee, the Board of Directors, and the Executive Committee on the implementation of the annual report and assessments from the PRI.

- Promotion of Green Leases. As described above, the status of the adoption of the Green Leases is monitored and tracked internally at the Asset Manager, reported to the Sustainability Committee and disclosed on our website.

- Human Resource Development. As described above, the internal training participation rate and the number of attendances at external training sessions are monitored and tracked internally by the Asset Manager, and reported to the Sustainability Committee on a quarterly basis. To ensure the accuracy of such human resources performance data, the ESG Promotion Department and the General Affairs Department engage a third-party consulting firm to conduct an independent review and obtain an annual assurance report on the accuracy of the data.

Limitations to methodologies and data

The primary limitation to methodologies and data is the necessity of our reliance on property management companies for raw environmental data at the property level. Like many other real estate investment corporations and asset managers, we rely on data provided by the property management companies. In addition, certain raw data at the property level provided by the property management companies is generally updated on an annual basis. Accordingly, certain property-specific data will therefore not always be fully up-to-date.

Data at the portfolio level are compiled internally at the Asset Manager. To ensure the accuracy of compiled data at the portfolio level, we have retained a third-party assurance organization to conduct independent review and provide an assurance report on the accuracy and quality of certain types of the compiled data at the portfolio level in accordance with our own criteria and methodologies. However, the independent review and assurance report do not provide independent verification of accuracy of raw data at the property level and the challenges associated with our reliance on the property management companies for raw data at the property level remain.

Limitations to the methodologies and data are not expected to affect the attainment of the environmental or social characteristics promoted by SHR in any material way.

Due diligence

Prior to SHR’s investment in a property, the Asset Manager conducts due diligence on the property, including environmental risk assessment, by investigating the history of use of hazardous substances such as asbestos and PCB, geological conditions and soil contamination. Such due diligence process encompasses various studies of ESG-related risks as a basis for deliberations at the Investment Committee and eventual investment decisions at the Board of Directors. We may cease consideration of the acquisition of a property or decide to acquire a property based on the ESG-related risks found as a result of the due diligence described above and whether such risks are deemed fixable or transferrable.

Also, the Sustainability Committee, the Compliance Committee and the ESG Promotion Department together manage and monitor overall risks related to sustainability, including climate change and ESG-related risks, post-acquisition. Based on the risk management rules overseen by the Board of Directors, the Asset Manager semiannually identifies, monitors and evaluates risks in each workflow of each department and reports the status thereof to the Board of Directors as appropriate. In connection with ESG-related risks, risk categories are selected and evaluated in accordance with the workflows of each department, and risk mitigation measures are studied as necessary.

Engagement policies

We do not consider investing in properties that do not meet the standards for soil contamination and other environmental contamination in accordance with the Air Pollution Control Act and the Soil Contamination Countermeasures Act of Japan and other environmental laws and ordinances. However, from time to time, SHR acquires properties not meeting the standards as long as they are deemed fixable promptly after acquisition. Also, we make investment decisions for properties outside Japan in accordance with the applicable environmental laws and ordinances in the respective jurisdictions and based on reasonable local practices.

When investing in properties using the proceeds of green bonds or green loans under our green finance frameworks described above, we do not consider properties that do not meet the eligibility criteria and do not qualify as Eligible Green Projects for investment.

In addition, we promote the conclusion of Green Leases with the tenants. We will promote Green Leases while strengthening cooperation with tenants.

SHR also does not invest in real estate assets involved in the extraction, storage, transport or manufacture of fossil fuels.

Designated reference benchmark

SHR has no benchmark index designated as a reference benchmark to meet the environmental or social characteristics promoted by SHR.

REMUNERATION AND SUSTAINABILITY RISKS (SFDR ARTICLE 5 DISCLOSURE)

The Asset Manager has a remuneration policy in place that aims to support its strategy, values and long term interest, including its interest in sustainability. The Asset Manager’s remuneration policy is consistent with the integration of sustainability risks as follows.

- Employees of the Asset Manager receive remuneration according to their occupation, responsibilities, skills, education, experience and, in some cases, sustainability targets.

- Remuneration, methods of calculation and payment, timing of payment, and increases in remuneration are determined according to the Asset Manager’s compensation rules, which are established based on statutory requirements.

- An employee’s base pay may be increased or decreased every April based on their ability, skills, role, qualifications, service record and other factors. Such increases or decreases may also be affected at any time in case of promotion, demotion, dismissal or for other grounds.

- Bonuses are calculated based on monthly base pay, payout rates, attendance and evaluations. Such evaluations take into consideration the employee’s contributions and conduct with respect to sustainability efforts and compliance requirements.

INTEGRATION OF SUSTAINABILITY RISKS IN THE INVESTMENT DECISIONS, AND THE IMPACT OF SUCH RISKS ON THE RETURNS OF SEKISUI HOUSE REIT, INC. (SFDR ARTICLE 6 DISCLOSURE)

As described in further detail above, the Sustainability Committee generally meets at least once every quarter, to establish targets, monitor compliance, evaluate the effectiveness of measures undertaken, discuss improvement measures, and make updates in line with our sustainable investment objective. We have instituted several initiatives, at both the portfolio level and the property level, to promote E/S characteristics. Such initiatives include climate change initiatives and energy saving initiatives, which are described in detail above.

While sustainability issues will severely impact our business activities, we believe that such issues may also become potential business opportunities to create new value for sustainable growth. Accordingly, we position our commitment to sustainability as a top priority in our management strategies. We also believe that integrating sustainability factors alongside traditional financial and operational metrics in our investment decision process helps us make a more holistic assessment of risks and opportunities with respect to SHR’s properties and is commensurate with the pursuit of superior risk-adjusted returns. We believe that our selection of “Prime Properties”, which are high-quality commercial or residential properties suitable for sustainable business operation or living for tenants, reflects our holistic approach, as we review, with respect to each such property, the economic area, convenience, functionality/livability, environmental consideration, business continuity plans/safety and brand.

Physical risks

The assets in which we invest are exposed to physical climate risks. These can manifest themselves through, for example, floods, storms, heat, earthquakes and limited access to natural resources. This can mean that the assets in which we invest become stranded assets. Specifically, for the assets in which the Asset Manager managed, the following risks are particularly relevant. The risks are assessed by the TCFD 4 ℃ scenario and 1.5 ℃ scenario respectively. More information can be found on the website: https://sekisuihouse-reit.co.jp/en/esg/environmental/tcfd.html

Transition risks

The assets in which we invest are exposed to transition risks. These can manifest themselves through, for example, changes in regulations, technical developments and/or social developments. Such developments may mean that the assets in which we invest become worthless. Specifically, for the assets in which the Asset Manager managed, the following risks are relevant. The risks are assessed by the TCFD 4 ℃ scenario and 1.5 ℃ scenario respectively. The result of the assessment of the transition risks of the 4℃ scenario has not been included in the following table because the impact was not significant. More information can be found on the website: https://sekisuihouse-reit.co.jp/en/esg/environmental/tcfd.html

This table can be scrolled sideways.

| 4℃ Scenario | ||||||

|---|---|---|---|---|---|---|

| Classification | Risk and opportunity factors, and financial impact | Period anticipated | Amount of financial implications | Countermeasures | ||

| Physical risks | Acute | Reduced rents due to inability to operate businesses due to flooding damage caused by typhoons, torrential rains, etc. | Medium and long term | (0.6) billion yen |

|

|

| Increase repair costs due to flooding damage | Medium and long term | (0.3) billion yen | ||||

| Chronic | Increase electricity costs due to increased air conditioning operation as a result of chronically rising temperatures | Medium to long term | (0.01 to 0.02) billion yen |

|

||

This table can be scrolled sideways.

| 1.5℃ Scenario | ||||||

|---|---|---|---|---|---|---|

| Classification | Risk and opportunity factors, and financial impact | Period anticipated | Amount of financial implications | Countermeasures | ||

| Transition risks | Policies, laws and regulations | Due to the introduction of carbon tax, tax burdens corresponding to GHG emissions will increase operating costs | Medium and long term | (0.1) billion yen |

|

|

| Increase in property renovation costs as energy regulations are tightened | Medium and long term | (0.7) billion yen | ||||

| Technology | Increase in the cost of introducing renewable energy and energy-saving technologies | Medium and long term | (0.1) billion yen |

|

||

| Reputation | Rising financing costs due to perceived inadequacy of response to climate change | Short, medium and long term | (0.05) billion yen |

|

||

| Market | Decreased competitiveness and rent income due to poor environmental performance of owned properties | Medium to long term | (1.45 to 1.6) billion yen |

|

||

| Physical risks | Acute | Reduced rents due to inability to operate businesses due to flooding damage caused by typhoons, torrential rains, etc. | Medium and long term | (0.3) billion yen |

|

|

| Increase repair costs due to flooding damage | Medium and long term | (0.1) billion yen | ||||

| Chronic | Increase electricity costs due to increased air conditioning operation as a result of chronically rising temperatures | Medium and long term | (0.01) billion yen |

|

||

(Note)The amount of financial implications is the annual implications estimated by the Asset Manager based on the actual performance of SHR and other factors, and with reference to various parameters based on scenarios presented by international organizations, etc. The accuracy of the figures is not guaranteed.

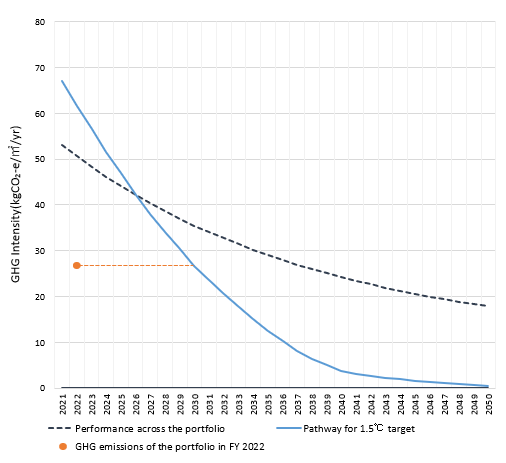

As a further step, we conducted a transition risk assessment analysis using the Carbon Risk Real Estate Monitor (CRREM) for the portfolio (the portfolio excluding properties held as of March 2022 that was sold or decided to be sold within one year). SHR will continue to take a strategic approach against climate change to both minimize risks and maximize opportunities.

Analysis Results

SHAM analyzed the potential stranded asset risk of the portfolio (the portfolio excluding properties held as of March 2022 that have been sold or decided to be sold within one year) using CRREM's risk assessment tool, as follows. The analysis is based on the Asia Pacific version of the tool (ver. 1.22), with some parameters (e.g., GHG emission factors for grid electricity) adjusted. The graph below shows a comparison of the performance of the portfolio and Global Pathways v2.01 (1.5℃ target).

CRREM Pathway Transition

- The performance across the entire portfolio is calculated based on the assumption that the current performance will continue based on the results of fiscal year 2021.

- Since there was no data on energy consumption in the residential areas of the properties at the time of the analysis, the average energy consumption of residential areas was set as an alternative value, based on the Tokyo Metropolitan Government’s survey on energy consumption trends in the residential sector.

In analysis results for the office portfolio conducted in 2022, with respect to the old 1.5°C pathway (Global Pathway v1.093), analysis results were below the old 1.5°C pathway until the first half of 2030 in the case where performance continued at the current level. This time, residential properties were also included in the analysis. In an analysis of the entire portfolio, with respect to the new 1.5°C pathway (Global Pathways v2.01) results showed that the new pathway would be exceeded much sooner, in the mid-2020s. The performance across the entire portfolio is calculated based on the results of fiscal year 2021, but if the performance results of fiscal year 2022 are maintained in the future, we can see that the timing of exceeding the new 1.5°C pathway can be postponed until 2030. Since we also plan to implement measures to reduce GHG emissions, we believe that the timing of exceeding the new 1.5°C pathway can actually be delayed further beyond 2030.

Social and governance risks

The assets in which we invest are exposed to social and governance risks as described below.

Bad governance risk: As prevention measures of conflicts of interest transactions, asset management stipulates Rules for Transactions with Interested Parties concerning transactions between the Interested Parties of asset management and us as an internal rule to exclude adverse effect of conflicts of interest. In addition, the Asset Manager stipulates in the “Compliance Manual” that the Asset Manager prohibits fraudulent acts, such as money laundering, insider transactions trading, bribery, embezzlement for self-interest and other similar violations, and it will strictly punish those who have committed such fraudulent acts. In addition, the Asset Manager is working to raise employee’s awareness by conducting compliance training for all employees appropriately. With these efforts, this risk is assessed as low for our assets.

Tax risk: Under tax law, investment corporations that meet certain requirements (conduit requirements) are allowed to include dividends of profits, etc. in their investment corporation's deductible expenses. However, if the conduit requirement is not met, dividends of profits, etc. may not be included in deductible expenses, resulting in an increased tax burden for us, which may adversely affect the amount of distributions to unitholders.