Environmental Initiatives Measures for Addressing Climate Change

Disclosure Based on TCFD Recommendation

In recent years, the environment, society and corporate activities have been exposed to major risks due to climate change such as global warming. SHR recognizes that resolving environmental issues such as climate change is one of the key issues for us, which aims to provide "bases for sustainable living" and "sustainable bases of operation for business" through ESG-conscious real estate investment management.

Based on the TCFD recommendations, SHAM identified and disclosed the risks and the opportunities posed by climate change to the business in 2020, and further analyzed and conducted a scenario analysis in 2021, using future climate projections published by international organizations and other sources as the main source of information. In 2022, in addition to analyzing the financial impact of the identified risks and opportunities, SHAM conducted an analysis using CRREM (Carbon Risk Real Estate Monitor). We will continue to enhance our resilience by enhancing information disclosure and by appropriately identifying and responding to transition and physical risks related to climate change through our initiatives in accordance with the TCFD recommendations, while simultaneously working strategically to create business opportunities.

Governance

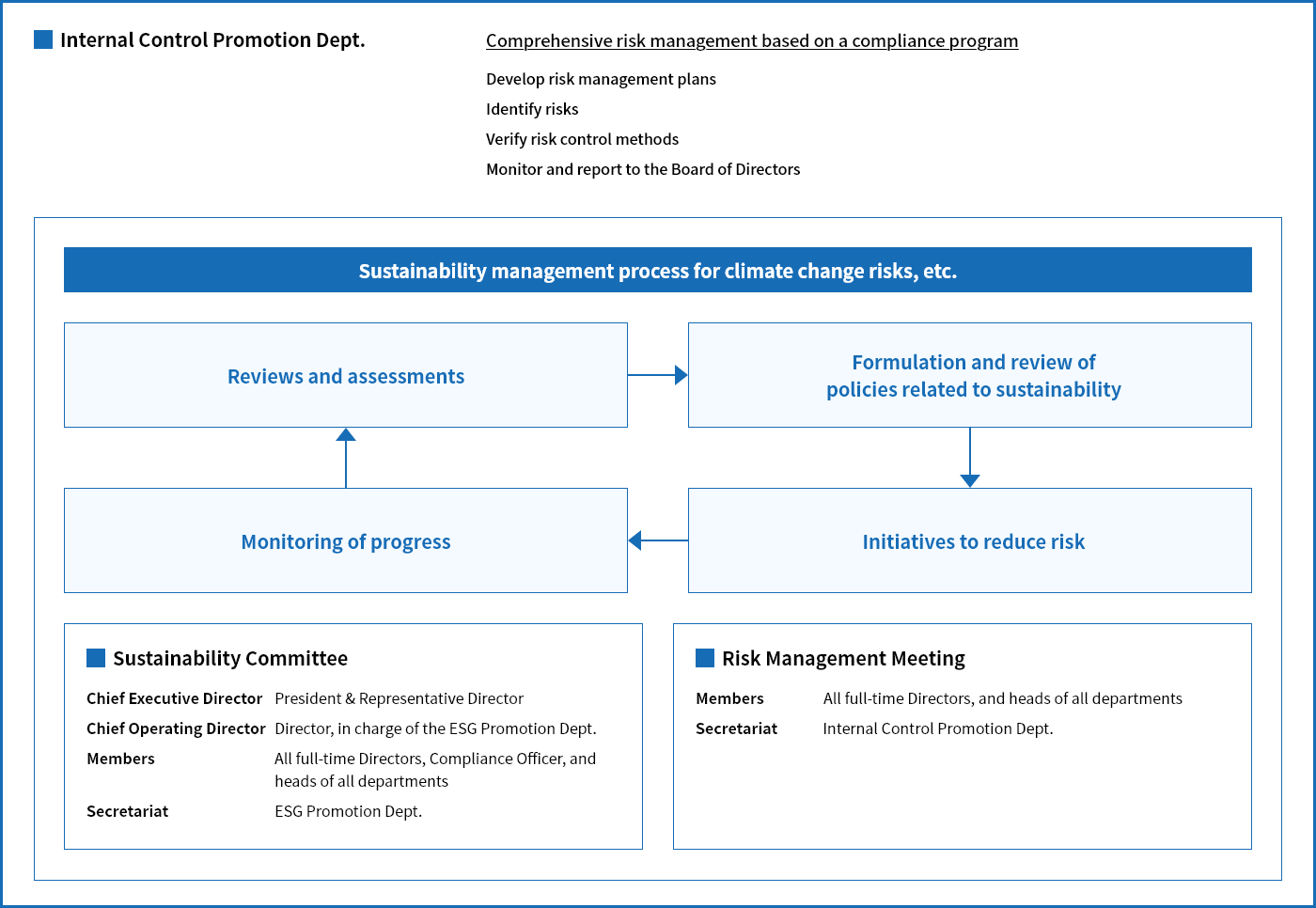

SHAM has established a Sustainability Committee as the decision-making body for sustainability issues. It meets at least once every three months to define policies, targets, and various measures related to sustainability and to discuss climate change risks (transition risks and physical risks) and material issues in relation to mitigation of and adaptation to climate change.

In 2020, in addition to defining the basic approach and organizational structure for addressing climate change-related issues, the Chief Sustainability Operator was appointed as the Director in charge of climate change, with the President & Representative Director as the Chief Sustainability Officer, in order to strengthen the promotion of climate change initiatives and clarify its responsibilities. These activities aimed at mitigating and adapting to climate change are reported as appropriate to the President & Representative Director, the Board of Directors of SHAM, and the Board of Directors of SHR.

In 2021, the Sustainability Committee expanded its membership to include the heads of all departments in an effort to raise awareness of sustainability and strengthen the organizational structure for promoting awareness. And in 2022, the “ESG Promotion Department” was established as a department dedicated to overseeing and managing ESG-related operations to strengthen the promotion system.

Click here for Sustainability Promotion System.

Strategy

Based on the recognition that climate change is an important issue that will have a significant impact on business activities, SHAM has set “Promoting Our Response to Climate Change” as a materiality of SHR, and views the various risks and opportunities associated with climate change as one of the key points in its business strategy.

Scenario Analysis

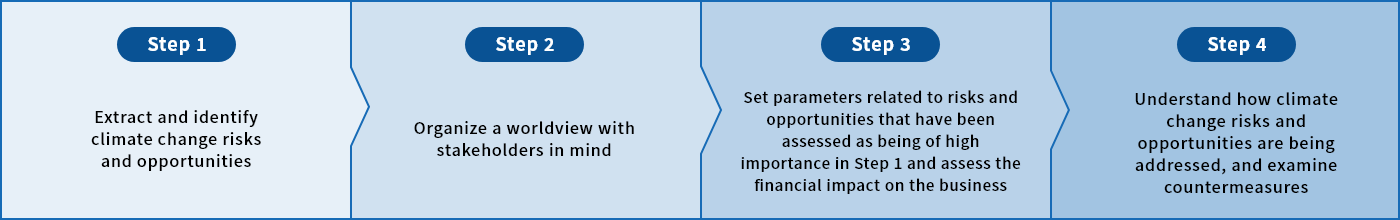

In order to assume various possible future events that could be caused by climate change and to understand the risks and opportunities for the business activities of SHR and assess the financial impact, SHAM used scenarios from international organizations and industry groups such as the IPCC (Intergovernmental Panel on Climate Change) and the IEA (International Energy Agency) to conduct an analysis for a world in which temperatures have increased by 4℃ and 1.5℃, respectively. Scenario analysis is conducted using the following process.

The Process for Conducting a Scenario Analysis

Risks and Opportunities Related to Climate Change

Risks related to climate change include risks associated with the transition to a decarbonized society ("transition risk"), such as tightening of regulations such as carbon tax, falling demand for companies that cannot respond to decarbonization, and a decline in reputation, and risks associated with the physical damage ("physical risk") caused by an increase in natural disasters and extreme weather events due to climate change. At the same time, we can also make assumptions regarding opportunities created by climate change.

This table can be scrolled sideways.

| Category | Changes in the World due to Climate Change | |

|---|---|---|

| Transition risks | Policy, and laws and Regulations |

|

| Technology |

|

|

| Market |

|

|

| Reputation |

|

|

| Physical risks | Acute |

|

| Chronic |

|

|

| Opportunities | Technology |

|

| Market |

|

A Worldview with Stakeholders in Mind by Scenarios

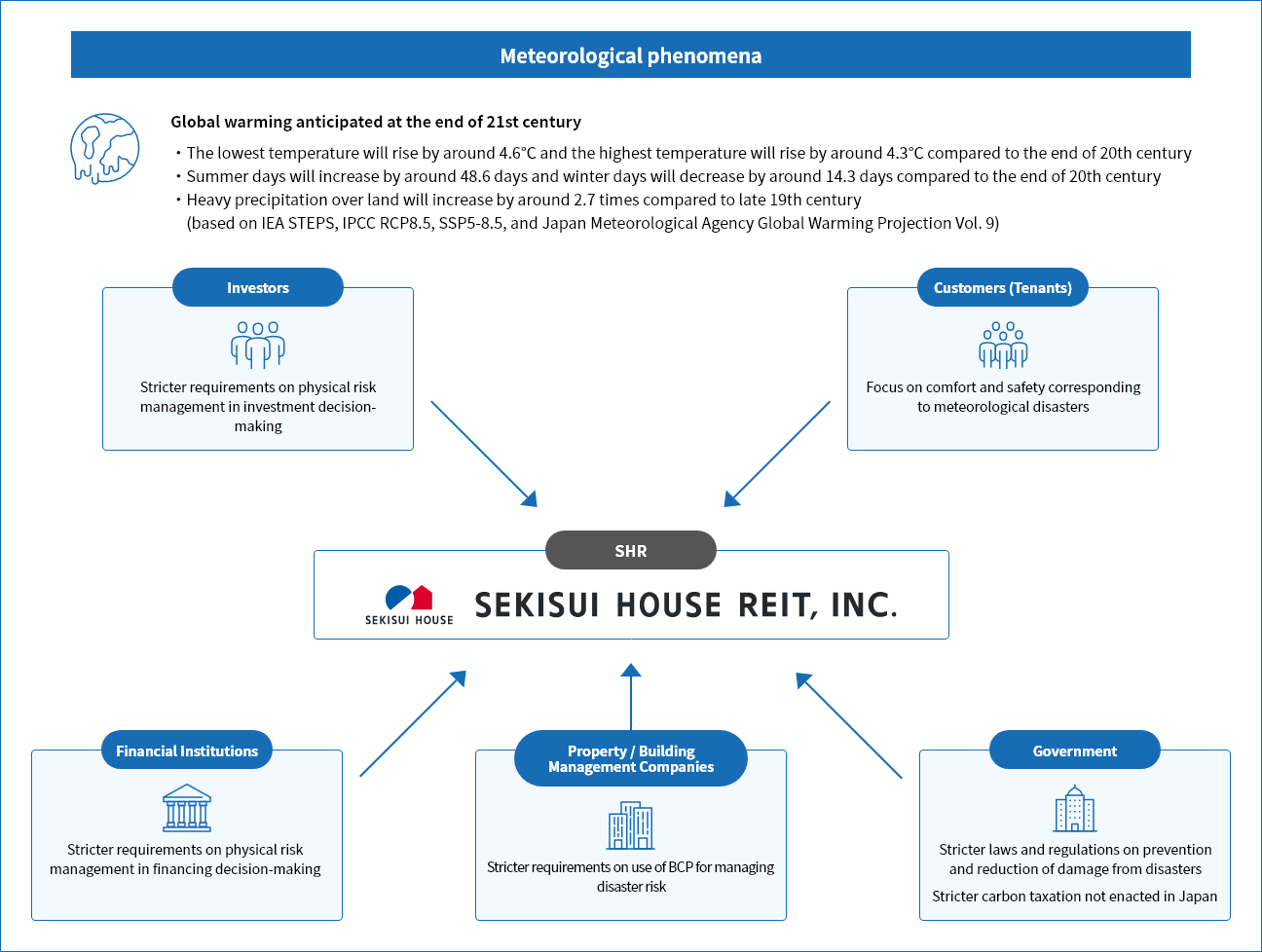

4℃ Scenario

The 4℃ scenario is a future view that assumes no strict regulations or tax reform aimed at decarbonizing society will be enacted and that greenhouse gas (GHG) emissions will continue to rise. This is a scenario in which the physical risk is relatively high and the transition risk is relatively low.

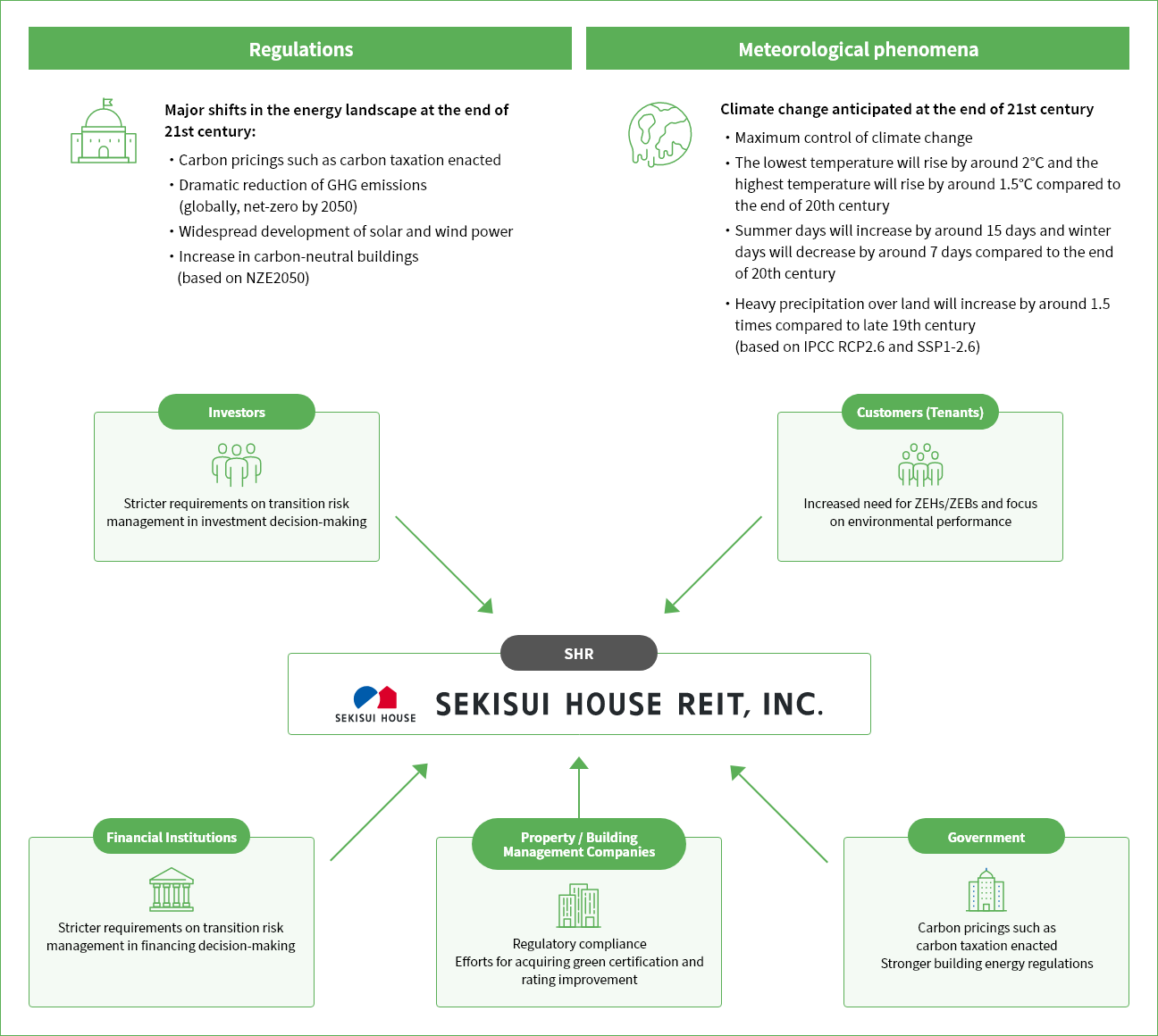

1.5℃ Scenario

The 1.5℃ scenario is a future view that assumes regulations and tax policies aimed at decarbonizing society will be enacted. This scenario is characterized by relatively low physical risk and relatively high transition risk.

Assessment of Financial Impact

Under the following assumptions, we set parameters to evaluate the financial impact of risks and opportunities faced by SHR, and calculate the impact by taking into account differences in parameters under each scenario. Furthermore, climate change risks are highly uncertain with respect to the timing and the scale of the risks that materialize, and it is extremely difficult to predict their financial impact. The current analysis places certain assumptions on the subject of the analysis, socioeconomic changes, and anticipated natural disasters, and does not take into account the probability that the identified risks/opportunities will be realized. Therefore, analysis methods will continue to be reviewed in the future in light of changes in the external environment.

This table can be scrolled sideways.

| Subject of Analysis | General business in real estate investment management and funding | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Anticipated Periods |

|

|||||||||||||||

| Category | Transition risks | Physical risks | ||||||||||||||

| Referenced Scenarios |

|

|

||||||||||||||

4℃ Scenario

This table can be scrolled sideways.

| Classification | Risk and opportunity factors, and financial impact |

Period anticipated | Amount of financial implications(Note) | Countermeasures | ||

|---|---|---|---|---|---|---|

| Physical risks | Acute |

|

Medium and long term | (0.6) billion yen |

|

|

|

Medium and long term | (0.3) billion yen | ||||

| Chronic |

|

Medium to long term | (0.01 to 0.02) billion yen |

|

||

| Opportunities | Technology |

|

Medium and long term | 0.15 billion yen |

|

|

1.5℃ Scenario

This table can be scrolled sideways.

| Classification | Risk and opportunity factors, and financial impact |

Period anticipated | Amount of financial implications(Note) | Countermeasures | ||

|---|---|---|---|---|---|---|

| Transition Risks | Policies, laws and regulations |

|

Medium and long term | (0.1) billion yen |

|

|

|

Medium and long term | (0.7) billion yen | ||||

| Technology |

|

Medium and long term | (0.1) billion yen |

|

||

| Reputation |

|

Short, medium and long term | (0.05) billion yen |

|

||

| Market |

|

Medium to long term | (1.45 to 1.6) billion yen |

|

||

| Physical risks | Acute |

|

Medium and long term | (0.3) billion yen |

|

|

|

Medium and long term | (0.1) billion yen | ||||

| Chronic |

|

Medium and long term | (0.01) billion yen |

|

||

| Opportunities | Technology |

|

Medium to long term | 0.2 to 0.3 billion yen |

|

|

| Market |

|

Medium to long term | 1.45 to 1.6 billion yen |

|

||

(Note)The amount of financial implications is the annual implications estimated by SHAM based on the actual performance of SHR and other factors, and with reference to various parameters based on scenarios presented by international organizations, etc. The accuracy of the figures is not guaranteed.

Analysis Results

Under the 4℃ scenario, no strict regulations or tax reform aimed at shifting to a decarbonized society are enacted, causing GHG emissions to continue rising. Physical risks due to changes in weather patterns such as intensifying weather disasters and chronic temperature increases are unavoidable. As a result, rent for owned properties are expected to decrease, while repair costs and electricity charges increase. SHAM is aware of the risk that flooding damage to its properties due to typhoons and heavy torrential rain, etc., could affect earnings. SHR owns 121 properties in Japan (as of March 2023), of which 55 properties are recognized as being at risk of flooding damage due to river flooding, etc., based on hazard maps and other survey data. Properties that are expected to suffer large amounts of damage are covered by insurance for more than the estimated amount. In such cases, there is also a risk that continuation of business operations will become impossible due to flooding damage, and rent income will decline. We are therefore seeking to reduce risks by taking out insurance to compensate for lost profits (indirect damage), the financial impact of which is calculated to be around 600 million yen. While these damages are calculated based on the assumption that similar damage occurs simultaneously in all areas where owned properties are located, we believe that the risk of such damage occurring simultaneously is low due to the dispersed location of properties owned by SHR.

Under the 1.5°C scenario, we expect to be affected by transition risks, such as tightening of regulations aimed at curbing GHG emissions toward the realization of a decarbonized society, and changes in property selection preferences due to increased environmental awareness among tenants. To respond to these risks, SHR calculates the impact of the introduction of a carbon tax on operating costs. In fiscal year 2022, GHG emissions decreased significantly due to the introduction of renewable energy, etc., resulting in a smaller impact of 100 million yen, which is lower than in the previous year’s analysis results. SHR is also working to reduce GHG emissions in its portfolio and obtain green certification for its properties. We have calculated the impact of the response to these restrictions at around 700 million yen, in anticipation of further tightening of environmental regulations such as energy-saving standards. With regard to the impact of changes in preference of properties by tenants, we have calculated that the impact on rent income if the acquisition of these properties does not proceed will be a decrease of up to 1.6 billion yen, while the effect on rent income if the acquisition proceeds will be an increase of up to 1.6 billion yen, assuming that the demand for properties with high environmental performance - such as ZEH - will increase.

In anticipation of the intensification of weather disasters indicated by the 4°C scenario, SHR invests mainly in properties that are resistant to risks such as flooding in terms of location and specifications, and with high environmental performance. Additionally, in order to respond to transition risks and maintain a competitive advantage in anticipation of the transition to a low-carbon society indicated by the 1.5°C scenario, we will work actively to address individual risks, by working to further reduce GHG emissions in our portfolio, acquire green certification, and actively investing in ZEH properties developed by Sekisui House. In this way, SHR is engaged in active efforts to respond to individual risks. As a result of these efforts, we believe that the impact of these risks on our business will be limited, and that these initiatives will lead to business opportunities for value creation.

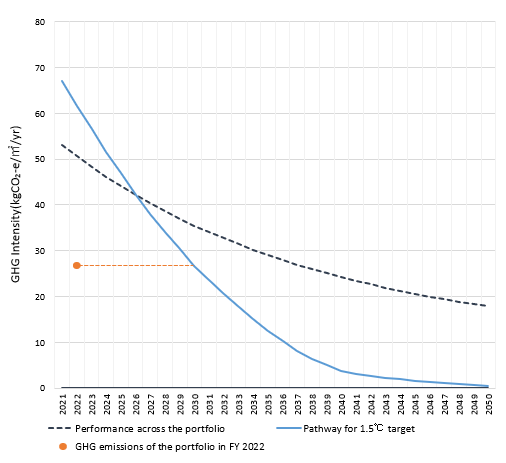

As part of our further responses, since fiscal year 2022, we have also been conducting transition risk assessment analysis using CRREM (Carbon Risk Real Estate Monitor). Going forward, SHR will continue to strategically address climate change, and work to reduce climate change risks and maximize opportunities.

Analysis According to CRREM

Overview of CRREM

CRREM (Carbon Risk Real Estate Monitor) calculates and publishes GHG emissions pathways (carbon reduction pathways) up to 2050 consistent with the 2℃ and 1.5℃ targets of the Paris Agreement for each use of real estate in a total of 44 countries (as of November 2023) in Europe, North America and the Asia-Pacific region including Japan. This tool is expected to be utilized for operational improvement by comparing the property data analyzed and pathways to calculate the timing of assets becoming stranded (Note) and carbon costs for each property, and to grasp the scale of renovation required to address these issues.

(Note)Stranded assets are assets that turn out to be worth less than expected as a result of changes (such as demands and market prices) associated with the transition to a low-carbon economy.

Analysis Results

SHAM analyzed the potential stranded asset risk of the portfolio (the portfolio excluding properties held as of March 2022 that have been sold or decided to be sold within one year) using CRREM's risk assessment tool, as follows. The analysis is based on the Asia Pacific version of the tool (ver. 1.22), with some parameters (e.g., GHG emission factors for grid electricity) adjusted. The graph below shows a comparison of the performance of the portfolio and Global Pathways v2.01 (1.5℃ target).

CRREM Pathway Transition

- The performance across the entire portfolio is calculated based on the assumption that the current performance will continue based on the results of fiscal year 2021.

- Since there was no data on energy consumption in the residential areas of the properties at the time of the analysis, the average energy consumption of residential areas was set as an alternative value, based on the Tokyo Metropolitan Government’s survey on energy consumption trends in the residential sector.

In analysis results for the office portfolio conducted in 2022, with respect to the old 1.5°C pathway (Global Pathway v1.093), analysis results were below the old 1.5°C pathway until the first half of 2030 in the case where performance continued at the current level. This time, residential properties were also included in the analysis. In an analysis of the entire portfolio, with respect to the new 1.5°C pathway (Global Pathways v2.01) results showed that the new pathway would be exceeded much sooner, in the mid-2020s. The performance across the entire portfolio is calculated based on the results of fiscal year 2021, but if the performance results of fiscal year 2022 are maintained in the future, we can see that the timing of exceeding the new 1.5°C pathway can be postponed until 2030. Since we also plan to implement measures to reduce GHG emissions, we believe that the timing of exceeding the new 1.5°C pathway can actually be delayed further beyond 2030.

Risk Management

SHAM has established an integrated risk management system for the purpose of accurately identifying various risks inherent in the execution of our operations, managing such risks appropriately, preventing risks from materializing, and minimizing losses when risks occur. In order to properly carry out organizational risk management, the Chief Manager of the Internal Control Promotion Department takes care of risk management as the chief supervisor, the head of each department is its own department’s responsible for each risk management, and the Internal Control Promotion Department is in charge of promoting risk management. Every business year, the Internal Control Promotion Department formulates a risk management plan for the following fiscal year, consisting of annual policies, priority management risks, and receives approval from the Board of Directors. The Internal Control Promotion Department also holds risk management meetings every six months, monitors the progress of the risk management plan, including climate-related risks, and reports the details to the Board of Directors. Under such risk management system, with respect to climate change, the Sustainability Committee of SHAM continuously identifies and assesses climate change risks and opportunities that may affect SHR’s operations, and updates its measures as deemed necessary by the President & Representative Director, who is also the Chief Executive Director of the Sustainability Committee. We clarify the methods for managing climate change risks and opportunities, and as part of our integrated risk management process, promote management of climate change risks/opportunities and initiatives related to resilience.

Click here for Risk Management System.

Indicators and Targets

SHR recognizes that solving environmental challenges, such as climate change, is one of the key issues for the sustainable growth of our business. We have identified “Promoting response to climate change” and “Investing in real estate with excellent environmental performance” as materialities and have established the following metrics and targets for use in identifying, evaluating, and managing climate change risks and opportunities. SHR has obtained SBTi Validation for the medium term GHG emissions reduction target.

For details of the SBTi Validation, please click here.

■ GHG Emissions Reduction Target

- Medium term target (by FY 2030): Reduce 42% of Scope 1 and Scope 2 emissions of portfolio compared to FY 2021

- Long term target (by FY 2050): Achieve net zero

- Calculate and reduce Scope 3 emissions

■ Energy Consumption Reduction Target

- Reduce 10% energy consumption intensity of portfolio by FY 2028 compared to FY 2018

In principle, reduction targets are set every 5 years after FY 2028.

■ Portfolio Green Certification Target

- Maintain 70% or more of the portfolio with green certification

Click here for indicators.

- Our Approach to Environmental Considerations, Environmental Performance

- Measures for Addressing Climate Change

- Coexistence of Humankind and Nature, and Initiatives for Environmental Resources

- Investing in Real Estate with Excellent Environmental Performance

- Collaboration with Tenants and Property Management Companies